U.S. Job Growth Slows to a Sustainable Pace: An Analysis for Investors

Submitted by Financial Investment Management | Conscience Bay Capital on October 5th, 2023

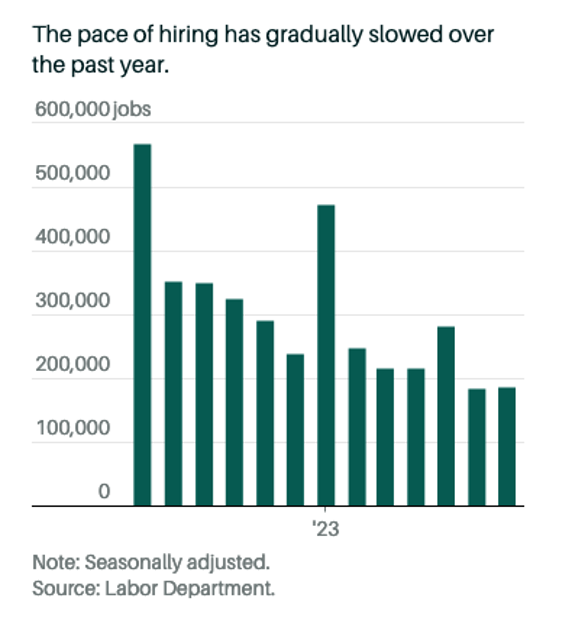

The latest job report reveals a notable slowing in the U.S. job growth as employers added 187,000 jobs in July, which is below economists' forecast of 200,000 positions. However, investors should not be alarmed as this change is indicative of a shift toward a more sustainable pace and, notably, still exceeds the pre-pandemic monthly average. The July figure is also slightly higher than June's revised payroll gain of 185,000. This article will delve into what this means for the economy and the implications for investment decisions.

A Shift Towards Sustainable Growth

While the headline number may seem like a disappointment, it's essential to understand that the reduced pace is a sign of stability rather than weakness. This growth rate is in line with what some economists consider the U.S. labor force can support over the long run, ensuring that growth remains manageable and consistent. It reflects a maturing recovery where employers are carefully aligning job growth with underlying economic fundamentals.

Unemployment Rate and Tight Labor Market

Another encouraging sign is the dip in the unemployment rate to 3.5% in July from June's 3.6%, against economists' expectations of no change. This dip further points to a tight labor market where employers are competing for workers, potentially driving wage growth. Such a scenario can lead to increased consumer spending and confidence, fueling further economic growth.

Implications for the Federal Reserve and Interest Rates

Given these figures, it seems unlikely that the Federal Reserve will take future interest-rate hikes off the table. Although the job growth has slowed, the consistent expansion and tight labor market may encourage the Fed to stay on the path of gradual monetary tightening. This could have several impacts on investors' portfolios, particularly in interest-rate-sensitive sectors like bonds and financials.

Investment Considerations

- Bonds: With the potential for interest rate hikes remaining, bond investors may want to consider short-duration securities that are less sensitive to interest rate changes.

- Equities: Sectors benefiting from economic growth and consumer spending may remain attractive, particularly as wage growth may spur more spending.

- The U.S. Dollar: The outlook on the U.S. dollar must be closely monitored as interest rate decisions can impact valuations.

While July's job growth figures may seem underwhelming at first glance, a deeper analysis reveals a trend toward sustainable growth, accompanied by a tight labor market. Investors should consider these dynamics in their asset allocation and investment strategy, keeping a close eye on potential interest rate movements by the Federal Reserve.

The economic landscape is complex, and an individual's investment strategy must be tailored to their specific needs, risk tolerance, and financial goals. You may want to reach out to your financial professional to discuss how these economic trends may impact your portfolio. Together, you can navigate the financial markets and work towards aligning your investments with the ever-evolving economic landscape.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

Because of their narrow focus, investments concentrated in certain sectors or industries will be subject to greater volatility and specific risks compared with investing more broadly across many sectors, industries, and companies.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This article was prepared by FMeX.

LPL Tracking #1-05377075